- The Baking Sheet

- Posts

- The Baking Sheet - Issue #283

The Baking Sheet - Issue #283

State of Tezos: Q3 Report

Hello everyone, and happy Thanksgiving weekend to everyone celebrating. It feels like the right moment to pause for a second and take stock of where Tezos stands this year. A lot has happened across the ecosystem, and this week gave us something rare: a wide-angle look at Tezos from the outside, thanks to Messari’s new State of Tezos Q3 report.

It is a solid reminder that the work happening across the ecosystem is adding up. Layer 1 activity climbed, Etherlink found its footing after a turbulent summer, DeFi grew in both usage and value, and the network continued to push upgrades at a steady pace. For anyone who follows Tezos closely, this report reads like a snapshot of a system that is quietly stronger than it was a year ago.

Other items on the plate this week, Revolut just announced that users will now keep one hundred percent of their Tezos delegation rewards. Tallinn is closing out its proposal phase with strong participation. Etherlink introduced its sixth upgrade proposal, Farfadet, and InfiniteInk opened its contract launchpad to everyone.

Let’s break it all down in this week’s edition of the Baking Sheet.

State of Tezos Q3: Reading the Messari Report

Every quarter, Messari puts numbers around things many of us feel day to day. Their new State of Tezos Q3 2025 report lands at a good moment to step back and ask a simple question: is Tezos actually gaining ground where it counts?

The short answer is yes, and the details tell a pretty encouraging story.

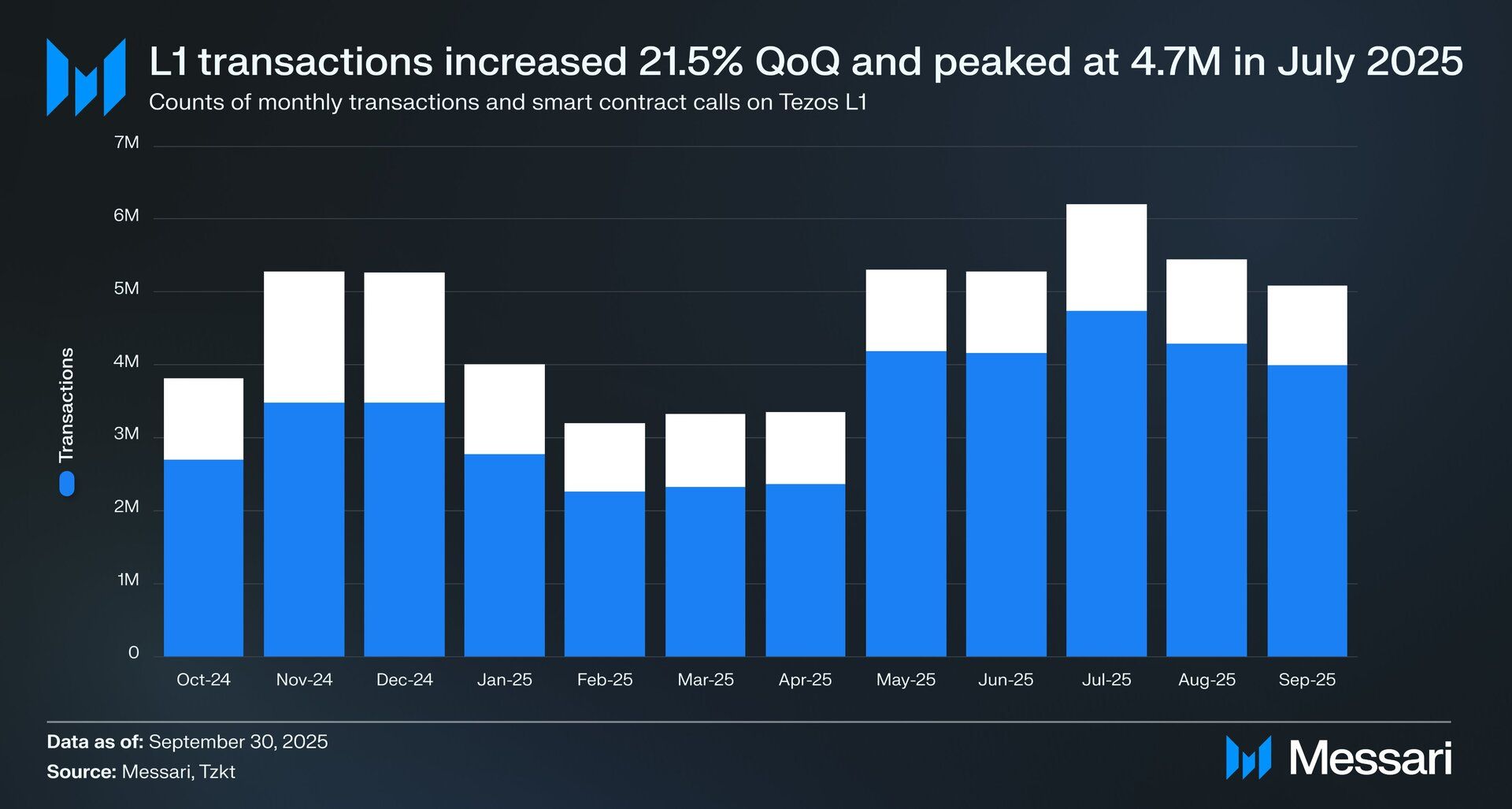

On Layer 1, activity moved in the right direction. Transactions on Tezos grew 21.5% quarter over quarter, with a peak of 4.7 million in July. Fees followed, rising 16.9% to 17,460 XTZ for the quarter. That is not meme-coin mania, it is a sign of steady use, helped along by upgrades like Paris and Seoul that made blocks faster and the staking experience smoother.

Etherlink, the EVM layer built on Tezos, had a more nuanced quarter. Fees on Etherlink dropped 36.7% to 50,220 XTZ, even as it continued to handle far more transactions than Layer 1. Part of that comes down to Kernel 4.1, which doubled the throughput target to 4 million gas per second and let the sequencer clear similar loads at a lower base fee. There were also some August infra hiccups and fast withdrawals went live, which removed some of the older, multi-step bridging flows that used to inflate activity.

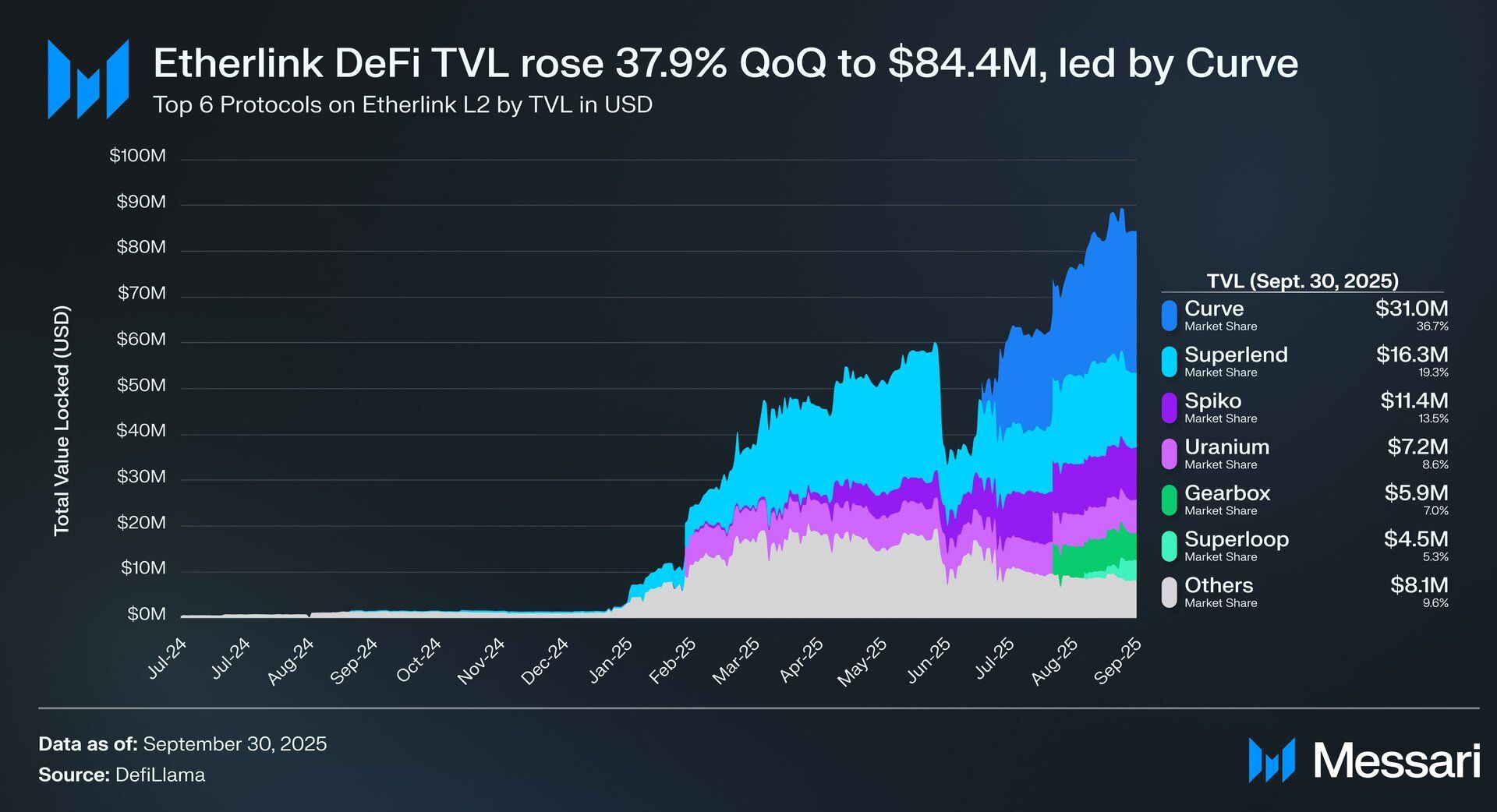

DeFi tells another important part of the picture. Tezos Layer 1 DeFi TVL climbed to 45.1 million dollars in Q3, up 13.1% from the previous quarter, with Youves alone reaching 31.4 million and holding close to seventy percent of L1 TVL. On Etherlink, TVL was more volatile. After a sharp mid-July drawdown, it rebounded more than 200% from the local low and finished the quarter at about 61.2 million dollars, up 46.9% overall. That recovery was driven by new programs and venues like Curve, Superloop, and the second season of Apple Farm incentives.

Under the hood, the report highlights how much of this momentum comes from steady protocol work. Etherlink’s Kernel 4.1 upgrade raised capacity while keeping fees tame. Seoul activated on Layer 1 in September with native multisig, aggregated attestations, and open unstake finalization, all of which make the base layer feel more usable and more “ready” for Tezos X.

Developer activity remains solid too. Across Tezos and Etherlink, more than 28,000 smart contracts were deployed in Q3, and Messari counts 229 monthly active developers working across thousands of repos, a sizable increase from the previous quarter. It is not just one or two teams shipping, it is a long tail of builders quietly pushing things forward.

Finally, the security side of the network stayed stable. Total staked XTZ dipped only slightly, from about 692.2 million to 688.1 million, and the validator set remains broadly distributed. In the context of Adaptive Issuance and the long-term Tezos X roadmap, that kind of consistency matters more than headline spikes.

Taken together, Messari’s Q3 snapshot reads like a network that is maturing into its next chapter. Layer 1 is busier and leaner, Etherlink is finding its footing as the main execution layer for DeFi, and the upgrade pipeline is still delivering exactly what Tezos needs for the Tezos X vision: lower latency, better composability, and room for builders to grow.

If you like charts while gathered at the table during Thanksgiving, you can dive deeper here.

Revolut Drops All Fees on Tezos Delegation Rewards

Coming off a quarter where the Messari report showed stronger on-chain activity, steadier growth in DeFi, and continued confidence in Tezos’ core economics, the timing of this next update feels almost perfectly aligned. One of the largest fintech apps in the world just made staking on Tezos even more appealing for everyday users.

Revolut announced that customers who hold tez will now receive 100% of their delegation rewards, with no platform fees taken out. That means rewards generated on-chain go directly to users, exactly as they should, without Revolut taking a cut.

The move lands at a helpful moment. With protocol upgrades like Rio shortening cycle times to a single day, staking and delegation changes settle faster on Tezos than ever before. Quicker cycles, liquid delegation, and now fee-free earnings on one of the most widely used finance apps create a much smoother path for retail users who want to participate without friction.

And Revolut’s reach is massive. More than 65 million customers use the platform, and only a handful of its 280+ supported tokens offer native earning features. Tezos is not only one of them, it is now one of the most user-friendly options on the list.

Revolut handles delegation behind the scenes. Users don’t pick validators or tweak settings; rewards simply accumulate while funds remain fully liquid. You can still trade or withdraw tez at any time, and the auto-delegation feature keeps working quietly in the background.

Nomadic Labs’ Vincent Poulain summed up the change well: “Revolut’s decision to pass 100% of delegation rewards to users demonstrates the compelling economics of Tezos; this creates an unbeatable user experience.”

Revolut echoed the same sentiment, noting that customers want their crypto “to work harder for them,” and making Tezos a frictionless earn option is a direct response to that demand.

For many people who discover Tezos through mainstream apps rather than crypto-native platforms, this is the kind of quality-of-life improvement that actually matters. You hold tez, and you earn. No locking, no extra steps, no platform fee, and no surprise deductions.

The bottom line is simple:

If you hold tez on Revolut, you now keep everything you earn.

Tallinn Governance Update: One Day Left in the Proposal Phase

With Revolut shining a bright light on Tezos this week, the protocol itself is also moving forward with real momentum. The Tallinn proposal has now cleared the 5 percent upvote threshold with plenty of room to spare, reaching close to 19 percent participation. That is more than 118 million upvotes, and it means Tallinn is fully on track to move into the next stage of the governance cycle once the proposal period ends tomorrow.

If you need a quick reminder of what Tallinn delivers, here are the highlights.

1. Six second block time

Tallinn continues the performance path we saw with Paris and Quebec. Layer 1 block time is lowered again, this time from 8 seconds to 6. The benefits are immediate:

smoother transactions on Layer 1

12 second finality

faster data availability for Etherlink and other L2s

quicker bridging and interchain operations

Importantly, this is achieved without increasing hardware requirements for bakers. Accessibility and decentralization remain intact.

2. All bakers attest every block once tz4 adoption passes 50 percent

Seoul introduced BLS aggregation. Tallinn takes the next step by allowing every baker to attest in every block once half of the network has migrated to tz4 addresses.

This brings:

stronger network security

predictable attestation rewards

lower load on nodes

a simplified consensus path

room for even shorter block times in future upgrades

Ledger devices cannot sign BLS fast enough, so bakers preparing for tz4 are encouraged to use the Tezos RPi BLS Signer, TezSign, or Signatory.

3. Address Indexing Registry

Tallinn introduces a global registry that stores each address once and assigns it a compact numeric ID. For large ledgers and NFT collections, storage can be reduced by 50 to 100 times.

That means:

lower contract storage costs

less on chain duplication

higher throughput

slower long-term storage growth

This feature will also be available on Tezlink, bringing the same efficiency improvements to the Michelson based Layer 2 environment.

As always, you can follow the proposal’s progress on Tezos Agora.

This Week in the Tezos Ecosystem

Etherlink Introduces Farfadet: The Next Major Upgrade Proposal

With Tallinn moving confidently into the next stage of Tezos governance, attention is now shifting to Etherlink where things are accelerating at the same pace. The teams at Nomadic Labs, TriliTech, and Functori have unveiled Farfadet, the sixth major kernel upgrade for Etherlink Mainnet, and it comes with a simple theme: more speed.

If adopted by L1 bakers, Farfadet will bring a set of deep improvements to Etherlink’s EVM environment. Some of these changes are breaking changes, which makes this a meaningful step forward for developers, dapp operators, and anyone building high-performance applications on Etherlink.

Here is what stands out.

1. Osaka Support Arrives

Farfadet adds support for the Osaka version of the EVM, rolling out immediately after Ethereum’s Fusaka hardfork. This keeps Etherlink aligned with modern EVM standards and unlocks new capabilities that developers have been waiting for.

Key features include:

EIP-7951: A new precompile for secp256r1 signature verification, allowing integration with Apple Secure Enclave, Android Keystore, HSMs, TEEs, and WebAuthn style authentication flows. This opens the door to advanced account abstraction setups.

EIP-7939: A CLZ opcode that optimizes foundational math and byte operations.

EIP-7883 and EIP-7823: A reworked ModExp precompile with more accurate gas costs and improved security. This is a breaking change that builders should review closely.

2. Capacity Almost Doubles

Etherlink’s capacity increases from 14 million gas per second to 27 million gas per second. This is one of the biggest throughput jumps yet.

In practice, this means:

Higher headroom during activity spikes

Transaction capacity comfortably above 1,000 native transfers per second

Stable gas prices as long as usage does not exceed long term thresholds

This continues Etherlink’s long term goal of staying ahead of demand and keeping the user experience fast and affordable.

3. Instant Confirmations Become Possible

Farfadet introduces instant confirmations, letting traders know within roughly 50 milliseconds whether their transaction will land in the next block and what the receipt will be.

Builders can test this today using the experimental eth_sendRawTransactionSync method in the latest Octez EVM node release. This feature gives low latency applications a major advantage and reflects Etherlink’s focus on sub second responsiveness.

The sequencer now advertises which transactions it plans to include, which helps clients compute expected receipts even before the block is produced. Future upgrades aim to push this latency target all the way down to the 5 millisecond range.

4. Breaking Changes for Builders

Farfadet includes a few developer facing updates that require attention:

FA Bridge events are now standardized with clearer, more predictable formatting.

ModExp gas updates require wallet providers and dapps to rely on updated gas estimation through the new kernel.

Certain event topics and system addresses have been adjusted, meaning some custom indexers will need small updates.

Most users will not notice these changes, but developers should review the changelog to ensure smooth compatibility.

5. Governance Timeline

Farfadet will be submitted to governance on the slow track. The expected timeline is:

Proposal Period: Beginning December 4, 2025

Promotion Period: Beginning December 8, 2025

Node operators will need the Octez EVM node version 0.48 or newer. An updated node with Farfadet native execution is also planned before Mainnet deployment.

For live updates, visit governance.etherlink.com.

InfiniteInk Launchpad Opens to Everyone

Wrapping up, this week also brings good news for artists and creators across the Tezos ecosystem. InfiniteInk, the launchpad for Tezos smart contracts, is now fully open to the public after a successful beta.

The team marked the milestone by committing to collect 3,000 tez worth of art minted on InfiniteInk throughout the next month. It is a simple and direct way to shine a spotlight on creators who explore the platform’s features.

How to get your work noticed:

Mint and list your piece on InfiniteInk

Share it on X and tag @InfiniteInk

Experiment with the different minting formats available, including editions, open editions, auctions and more

The goal is to highlight a wide range of styles and approaches, showcasing what IINK makes possible for artists who want more flexibility and ownership in how they publish their work.

You can start creating at: https://infiniteink.art

🔴 Now Streaming: From London to Layer 2 - Aaron Mallet on Scaling the Tezos Ecosystem

This week on TezTalks Live, host Stu welcomes Aaron Mallet, Growth Manager at Trilitech, for a deep conversation on what it means to build momentum in the Tezos ecosystem. From London, Aaron shares how Etherlink and the broader Tezos X vision are reshaping the network’s trajectory in 2025 — across DeFi, gaming, and beyond.

Our guest is Aaron Mallet, Growth Manager at Trilitech, where he works closely with builders, bakers, and partners to accelerate adoption and support the next generation of Tezos projects.

🔍 In this episode, we explore:

The role of a Growth Manager and how Trilitech supports the broader Tezos ecosystem

Etherlink’s impact on DeFi and what its next upgrade could unlock.

How Apple Farm and Appleville helped define a new era of Tezos DeFi and on-chain engagement.

Why Tezos X represents the next step toward a more scalable, connected ecosystem.

The emerging relationship between DeFi and gaming on Tezos, and how each brings new value and users.

The importance of staking and how it strengthens network security and community ownership.

Watch the full episode on YouTube.